Navigating the world of life insurance can be a challenge, especially if you don’t know what you are looking for. One of the biggest stumbling blocks is knowing the difference between life insurance and life assurance. If you want to ensure that your family are looked after and protected when you’re gone then you may automatically start looking for a life insurance policy. But is that the right policy for you?

While both are forms of protection that will payout once you’ve passed away, they work very differently. This guide summarises our expert advice, including the differences between life insurance and life assurance, and what each means for you and your family.

What is life insurance?

The term and policy that you will be most familiar with is life insurance. Most people recognise the importance of having a life insurance policy in place to protect their loved ones once they’re no longer here. But it is important that you know exactly how they work and how much protection they offer.

The most important thing you should know about life insurance is that it is designed to protect and cover the policyholder for a specific period of time. This means that if you die during the term of the policy then a lump sum is paid to whoever you have named.

One example of an effective life insurance policy is one that covers you for the same amount of time as your mortgage. This is where you pay a monthly premium so that if you pass away during that time, the policy pays off the rest of your mortgage. However, there are different life insurance policies that you may be familiar with. It is also possible to have a number of life insurance policies in place at one time.

What types of life insurance policies are there?

Level – the same amount of cover is provided for the duration of the policy

Increase – this is where your cover increases over time, as do the premium amounts you pay.

Decrease – this type of life insurance pays out less over time. This is often used for mortgages as the total balance of your mortgage decreases over time as you reduce the balance.

But whichever policy you go for, remember that life insurance only covers you for the duration of the policy. So if you do not die during the time stated in the policy, then it will not pay out.

What is life assurance?

Life assurance is a form of life insurance that lasts as long as you keep making monthly payments. It is a policy that is guaranteed to pay out no matter when you pass away. Life assurance policies have no term or duration clauses and instead will last until you die. This may see it referred to as whole life insurance; as you are covered for your whole life.

This kind of cover is called life assurance meaning that you have an assurance that the policy will pay out – no matter when you die. Due to this guarantee, you will find that they are usually more expensive than life insurance policies.

When taking out the policy you will need to decide how much you want your loved ones to receive when you’re gone and then you’ll be required to pay monthly premiums to maintain the policy. Remember that the bigger the lump sum payout, the higher the premiums. You may find that once you hit a certain age a provider will allow you to stop paying your premiums and retain your cover, but this isn’t always the case.

Life assurance policies also have an investment element which allows the capital from the policy to be invested into the stock market. This means that the money paid out to your family may grow over time. But of course, any investment comes with a risk, so if stocks fall then you may need to higher your premiums to ensure enough money is paid in.

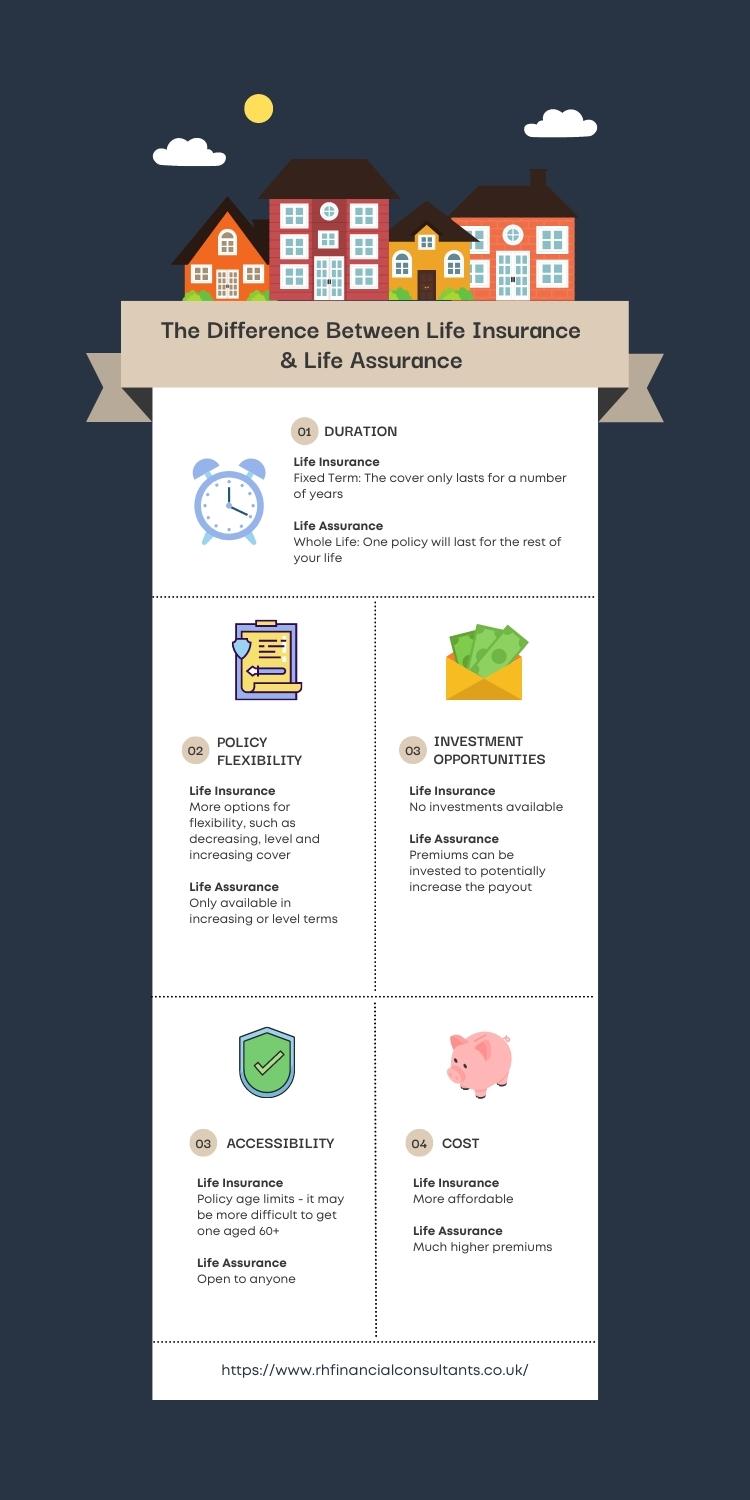

What is the difference between life assurance and life insurance?

While both types of cover offer you and your family protection when you’re no longer here, there are important differences you should be aware of:

Life insurance Vs Life assurance – Which one is right for me?

Now that you know the difference between life insurance and life assurance policies you can find out which policy to go for. When comparing life insurance v life assurance, It is important to know that the right cover for you will depend on your circumstances. No two people are the same, so just because your friend or relative has a certain policy, doesn’t mean that’s the one you should go for.

You should consider the features discussed above and consider factors, such as outstanding mortgages and how much money you want to leave behind when deciding which policy is the best fit.

Struggling to find out which is the best policy for you? Our team of financial consultants can provide you with all the expert information you need to make the best choice for you and your family. Get in touch for a free consultation today!